As the holiday season approaches and families across the nation gear up for Thanksgiving feasts and festive gatherings, a wave of financial relief is sweeping through New York State in the form of inflation refund checks. While viral headlines tout “$1,000 + $1,600 inflation refund checks mailed to everyone,” the reality is even more grounded in good news: Governor Kathy Hochul has announced that over 8.2 million inflation refund checks—up to $400 each—have been mailed out, with the bulk arriving just in time for Thanksgiving 2025. This isn’t a nationwide giveaway but a targeted state initiative to ease the sting of rising costs on everyday New Yorkers, from grocery bills to utility spikes.

For residents still reeling from post-pandemic inflation, these inflation relief payments represent a timely boost, potentially totaling more than $2.5 billion in direct aid. Whether you’re a single filer pinching pennies or a family stretching the budget for holiday extras, understanding the New York inflation refund checks can help you maximize this windfall. Drawing from official announcements from the New York Department of Taxation and Finance, we’ll break down eligibility, payment timelines, and smart ways to use your check. If you’ve been searching for inflation stimulus updates or wondering about state rebate programs, this guide has you covered with the latest as of November 28, 2025.

What Are the New York Inflation Refund Checks All About?

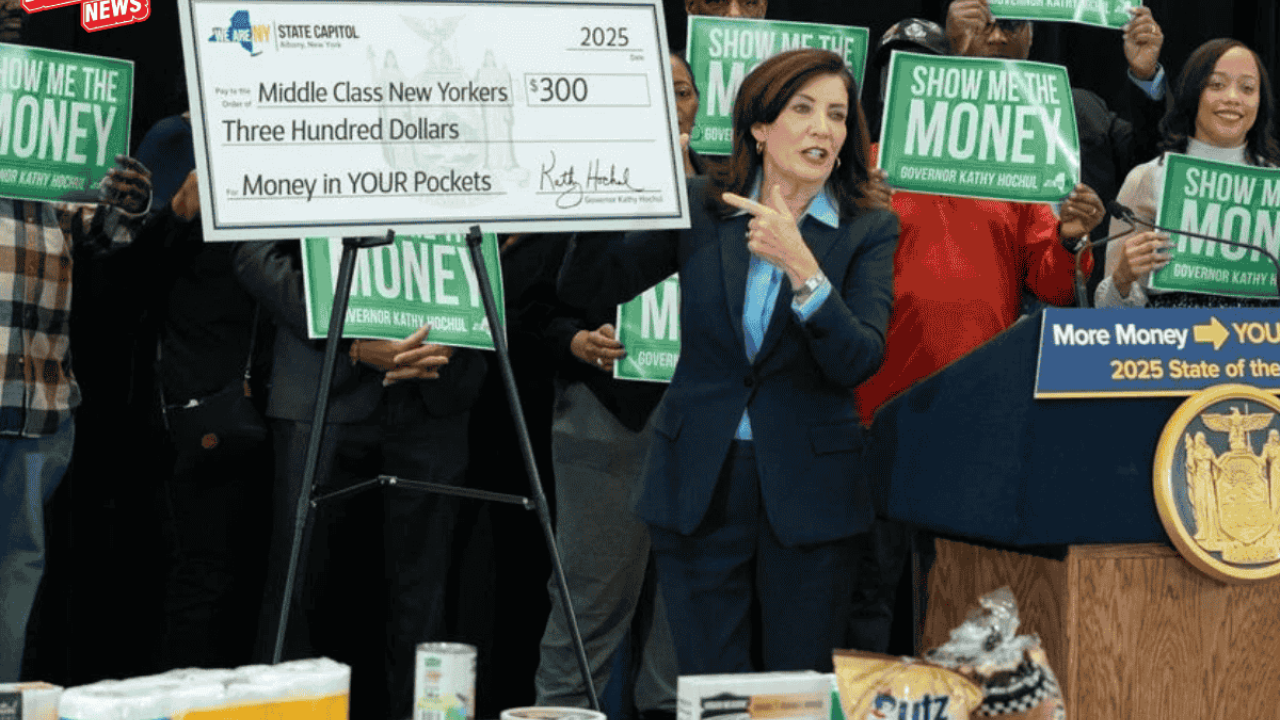

The New York inflation refund checks stem from the 2025-2026 state budget, marking the Empire State’s first-ever program of its kind to counteract the higher sales taxes paid amid inflation. Unlike federal stimulus checks from the COVID era, these one-time inflation relief payments are automatically issued to qualifying taxpayers as a rebate on everyday purchases that got pricier over recent years. Governor Hochul’s administration framed it as a “proactive measure” to put money back into pockets before the holidays, aligning with broader efforts to support working families and seniors on fixed incomes.

At its core, the program reimburses eligible residents for the extra taxes shelled out on inflated goods and services, with checks ranging from $100 to $400 based on income and filing status. While not the “$1,000 + $1,600” bonanza splashed across social media (often a mix-up with layered federal credits or other rebates), the collective impact is substantial—over 8 million households could see relief just in time for Thanksgiving dinner or Black Friday shopping. This initiative builds on similar state rebates seen in places like California and Colorado, but New York’s scale and timing make it a standout for 2025 inflation stimulus seekers.

Who Qualifies for the Inflation Refund Checks in 2025?

Eligibility for New York inflation refund checks is broad and hassle-free, designed to reach most taxpayers without extra paperwork. If you filed a 2023 New York state income tax return (the basis for 2025 distributions), you’re likely in line for one of these inflation relief payments. Here’s a quick rundown of the key qualifiers to confirm your spot:

- Income-Based Tiers: Singles or married filing separately with incomes up to $150,000 get the full $300; heads of household or married filing jointly up to $300,000 receive $500. Lower earners (under $100,000 single/$200,000 joint) snag $400, prioritizing those hit hardest by inflation.

- Filing Status and Residency: U.S. residents who filed Form IT-201 or IT-203 for 2023 taxes qualify automatically. Non-residents with New York-sourced income may also be eligible, but part-year filers get prorated amounts based on residency days.

- Exclusions and Special Cases: Those who didn’t file 2023 returns (e.g., non-filers with zero income) won’t qualify unless they submit now—though the window is closing fast. Dependents claimed on another’s return and certain high-income brackets are out, but SSI/SSDI recipients often slide in via automatic processing.

No action is needed if you qualify; the state cross-references tax records to mail checks. If your 2023 filing was incomplete or you’re unsure, use the Department of Taxation’s online portal to verify status and avoid missing your inflation refund check amid the holiday mail rush.

Payment Amounts, Mailing Timeline, and Delivery Details

The beauty of these New York inflation refund checks lies in their simplicity and speed—automatic mailing means no claims or lotteries, just relief landing in your mailbox. Checks began rolling out at the end of September 2025, with the main phase wrapping up by mid-November to hit homes ahead of Thanksgiving. As of November 26, Governor Hochul confirmed over 8.2 million payments dispatched, totaling up to $400 per eligible household, distributed in waves to manage the massive volume.

Expect your check via U.S. mail to the address on your 2023 return—direct deposit isn’t an option here, but processing prioritizes urban areas like NYC first, with rural spots following suit. Smaller batches continue into December for late discoveries, so if nothing arrives by mid-December, contact the Tax Department at 518-457-5181. These inflation relief payments are taxable as income, so set aside a bit for 2025 filings, but the net gain still packs a punch for holiday budgeting or debt reduction.

How to Use Your Inflation Refund Check Wisely This Holiday Season

Landing an unexpected $300-$400 windfall? Smart spending can turn these New York inflation refund checks into lasting financial wins, especially with Thanksgiving and Christmas looming. Prioritize essentials first, then layer in some joy—here’s how to stretch your inflation relief payment:

- Tackle Essentials: Cover rising grocery costs for that turkey dinner or stock up on winter utilities—many families report using rebates to offset 10-15% of monthly bills.

- Build Security: Stash 20-30% in a high-yield savings account (aim for 4%+ APY) as an emergency buffer, countering ongoing inflation pressures.

- Holiday Boost: Splurge modestly on gifts or a family outing, but cap it at 25% to avoid post-holiday regret—think local shops for that economic ripple effect.

- Pay Down Debt: Apply to high-interest credit cards or loans; even $200 knocked off balances saves big in 2026.

- Invest in You: Fund a course, gym membership, or home repair—these inflation stimulus-like checks shine when fueling long-term growth.

By blending practicality with a touch of festivity, your inflation refund check becomes more than cash—it’s a step toward stability in uncertain times.

Beware of Scams: Viral “$1,000 + $1,600” Headlines and How to Spot Fakes

Amid the excitement over New York inflation refund checks, scammers are peddling fake “$1,000 + $1,600 stimulus” schemes via texts and emails, promising “upgrades” for a fee. Remember, legitimate inflation relief payments come solely from the state—no IRS involvement, no upfront costs, and no links to click. Official notices arrive by mail only, and the Tax Department’s site (tax.ny.gov) is your sole verification hub.

If a message demands personal info or payment to “claim” funds, report it to the FTC at ftc.gov/complaint. These tactics prey on holiday hope, but sticking to verified channels ensures your real inflation refund check arrives safely. Share this tip with neighbors—protecting one another keeps the good news genuine.

The rollout of over 8.2 million New York inflation refund checks is a beacon of relief in 2025’s economic landscape, proving state governments can deliver swift, meaningful inflation relief payments. While not the nationwide “$1,000 + $1,600” dream, $300-$400 per household adds up to real impact for Thanksgiving tables and beyond. Monitor your mail, plan your spend, and celebrate the win—here’s to grateful hearts and fuller wallets this holiday. For personalized advice, consult a financial planner or the state’s helpline.

FAQs:

Are the $1,000 + $1,600 inflation refund checks real and mailed to everyone?

No, the viral “$1,000 + $1,600” figure is exaggerated—New York’s actual inflation refund checks are up to $400 per eligible household, mailed automatically to over 8.2 million residents as of November 2025, not nationwide.

Who qualifies for New York inflation refund checks ahead of Thanksgiving?

Most 2023 New York tax filers qualify based on income (up to $400 for under $100,000 single/$200,000 joint), with automatic eligibility—no application needed if you filed on time.

When will my inflation relief payment arrive in the mail?

Mailing started late September 2025, with the main wave complete by mid-November for Thanksgiving delivery; stragglers continue into December—check your 2023 tax address for updates.

Are these inflation refund checks taxable, and how should I use them?

Yes, they’re considered income for 2025 taxes, but the net boost is worthwhile. Use wisely for essentials, debt, or savings to combat ongoing inflation—many apply to holiday groceries or bills.